Customer Service Lines Open Mon-Fri 9am-6pm

[ Contact Us ]

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926Do you have a question? or need help?

Customer Service Lines Open Mon-Fri 9am-6pm, Closed Saturday & Sunday

When you are thinking about buying any type of insurance policy it is only natural to want to know how much actual claims cost. This way you can evaluate the cover available, and make a decision if you feel it is valuable to you.

At Total Loss Gap, we provide a range of additional products to our core GAP Insurance products. These include:

SMARTCare Cosmetic Insurance (combined alloy wheel, scratch & dent, and interior repair insurance)

Although these products can be bought separately, they are often bought as additional cover to a GAP Insurance policy by our customers.

The value of GAP Insurance is clear to many. An ‘all-or-nothing’ type cover that can only be claimed on once, in the event that the vehicle is written off as a total loss by your motor insurer. This may result in a claim of many thousands of pounds being made to you.

The additional products are quite different. They normally offer multiple claim opportunities over your period of cover. The cost of these claims may be to cover the costs of a replacement tyre, or a repair to an alloy wheel or to the bodywork of the vehicle. As such, these claims will be smaller in value than a GAP Insurance policy. But just how much do they cost?

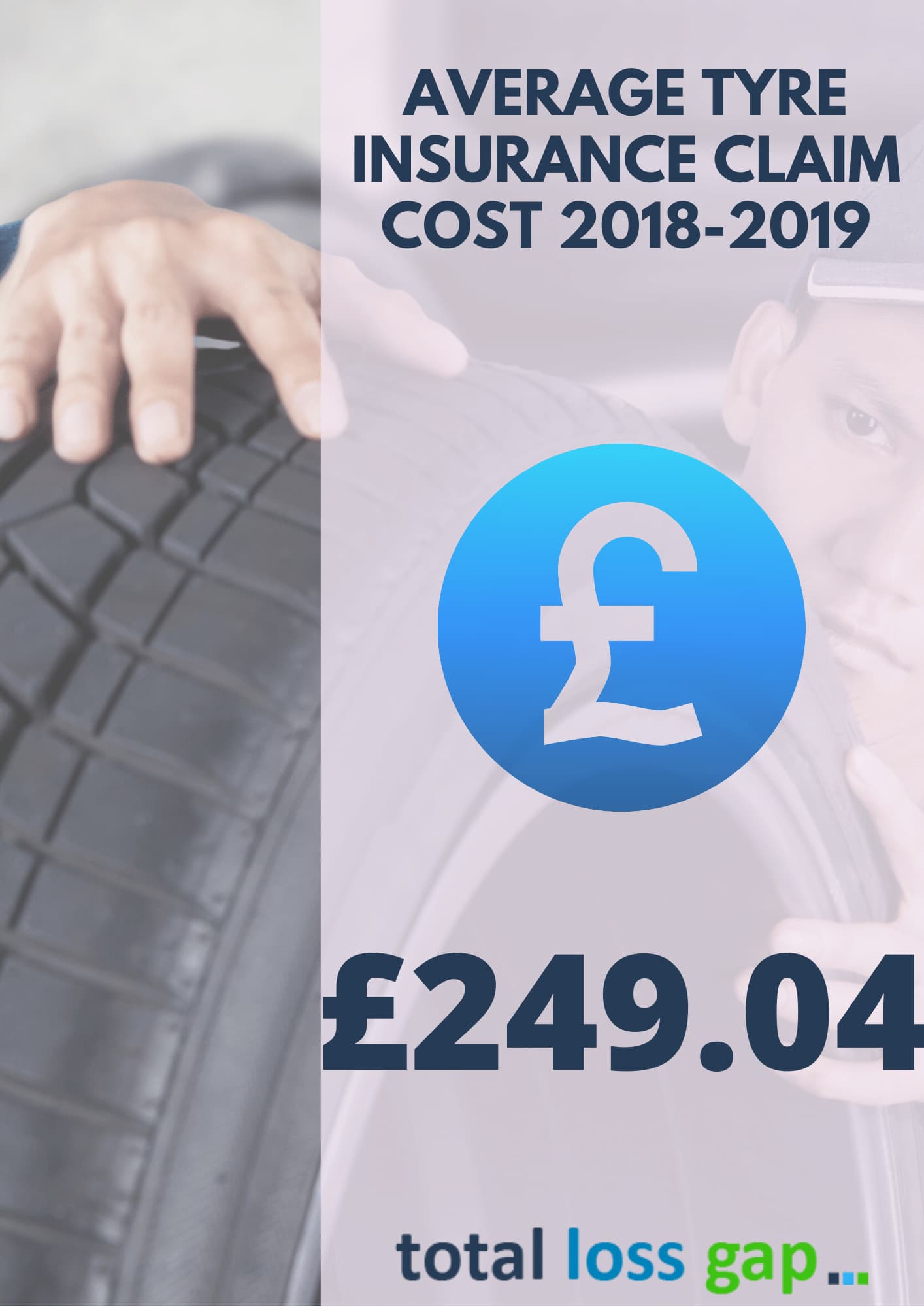

We have gathered claim data from our very own customer claims between 2018 and 2019. These show the average cost per claim for each type of cover.

With the tyre insurance cover from Total Loss Gap, you can make up to four claims per annum month period of cover. Each claim can cover up to £350 for a replacement tyre and up to £50 for a puncture repair.

We can cover standard, run-flat and N rated tyres of up to 22 inches in diameter.

Our data shows us that of the Tyre Insurance policies we have currently, our customers' average cost per claim is £249.04.

The alloy wheel insurance policy we offer allows for up to four claims per annum of cover. The policy can cover the cost of making a cosmetic repair to your alloy wheel, typically following where you may have ground the alloy against the kerbstone when parking.

The alloy wheel insurance policy we offer allows for up to four claims per annum of cover. The policy can cover the cost of making a cosmetic repair to your alloy wheel, typically following where you may have ground the alloy against the kerbstone when parking.

Our alloy wheel cover can include standard, painted, diamond or laser cut finished wheels.

Our data shows that the average claim costs against our alloy wheel insurance policies were £95.59 between 2018 and 2019.

Remember you can take Alloy Wheel Insurance as a stand-alone policy, or as part of a combined package. Our combined policies, which include alloy wheel cover, would be either a Complete Wheel Insurance (tyre & alloy wheel cover) or SMARTCare (alloy wheel, scratch & dent, and interior repair insurance).

Scratch & Dent Insurance average claim costs.jpg)

This type of insurance can be known by a few different names. Cosmetic Repair Insurance, Minor Damage Insurance, Ding and Dent Insurance are all alternative names for this cover. Basically, it is designed to cover the costs of minor cosmetic repairs to the bodywork of your vehicle.

The type of damage you will see claimed for will include bumper scuffs, small key scratches and supermarket trolley dings.

The policy can cover areas of damage up to 15cm on the stand-alone product, but up to 30cm when bought as part of the combined SMARTCare policy.

Our data shows that the average cost of a claim on our scratch and dent policy was £158.85 between 2018 and 2019.

This is a question only you can answer. However, with many policyholders making multiple claims on these types of cover, taking into account the average claim costs, why they do provide valuable protection to many policyholders.